Featured

Table of Contents

Note, however, that this does not claim anything regarding changing for inflation. On the plus side, also if you think your option would certainly be to purchase the stock market for those seven years, which you 'd obtain a 10 percent annual return (which is much from particular, specifically in the coming years), this $8208 a year would be more than 4 percent of the resulting small stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 payment choices. The regular monthly payment below is highest possible for the "joint-life-only" choice, at $1258 (164 percent greater than with the instant annuity).

The method you acquire the annuity will certainly determine the answer to that inquiry. If you buy an annuity with pre-tax dollars, your premium reduces your taxed revenue for that year. According to , purchasing an annuity inside a Roth plan results in tax-free payments.

What are the benefits of having an Fixed Indexed Annuities?

The consultant's primary step was to develop a thorough financial strategy for you, and after that describe (a) just how the proposed annuity matches your general strategy, (b) what alternatives s/he thought about, and (c) how such alternatives would certainly or would not have resulted in lower or higher compensation for the consultant, and (d) why the annuity is the exceptional choice for you. - Annuity withdrawal options

Naturally, an advisor might attempt pushing annuities also if they're not the finest fit for your situation and goals. The factor could be as benign as it is the only item they sell, so they drop target to the proverbial, "If all you have in your toolbox is a hammer, rather soon every little thing begins appearing like a nail." While the consultant in this situation might not be dishonest, it boosts the threat that an annuity is an inadequate option for you.

How do Fixed Annuities provide guaranteed income?

Since annuities commonly pay the representative offering them a lot higher payments than what s/he would receive for spending your cash in shared funds - Lifetime payout annuities, let alone the zero payments s/he would certainly obtain if you purchase no-load shared funds, there is a large reward for agents to press annuities, and the a lot more complex the far better ()

An unscrupulous consultant suggests rolling that quantity into brand-new "better" funds that simply happen to bring a 4 percent sales tons. Accept this, and the expert pockets $20,000 of your $500,000, and the funds aren't most likely to carry out better (unless you picked also a lot more improperly to start with). In the exact same example, the advisor might guide you to get a complicated annuity keeping that $500,000, one that pays him or her an 8 percent payment.

The consultant hasn't figured out how annuity repayments will be tired. The advisor hasn't disclosed his/her compensation and/or the charges you'll be charged and/or hasn't revealed you the impact of those on your ultimate settlements, and/or the settlement and/or charges are unacceptably high.

Your family members history and present wellness factor to a lower-than-average life span (Secure annuities). Existing rate of interest prices, and therefore projected payments, are traditionally reduced. Even if an annuity is best for you, do your due persistance in contrasting annuities sold by brokers vs. no-load ones offered by the issuing firm. The latter may need you to do even more of your very own research study, or use a fee-based monetary advisor who might obtain payment for sending you to the annuity provider, however may not be paid a greater commission than for other financial investment options.

Who provides the most reliable Annuity Contracts options?

The stream of monthly settlements from Social Safety and security resembles those of a delayed annuity. Actually, a 2017 relative evaluation made a comprehensive contrast. The complying with are a few of the most salient points. Given that annuities are voluntary, the individuals getting them typically self-select as having a longer-than-average life expectations.

Social Protection advantages are fully indexed to the CPI, while annuities either have no inflation security or at the majority of provide an established portion annual rise that might or might not make up for inflation in full. This type of biker, just like anything else that increases the insurer's risk, needs you to pay more for the annuity, or approve reduced payments.

Can I get an Fixed Indexed Annuities online?

Disclaimer: This short article is planned for informational purposes only, and must not be considered financial advice. You must consult a financial specialist prior to making any type of significant monetary choices.

Considering that annuities are planned for retirement, tax obligations and penalties might use. Principal Protection of Fixed Annuities.

Immediate annuities. Deferred annuities: For those that want to expand their money over time, but are eager to defer accessibility to the cash till retired life years.

Annuity Riders

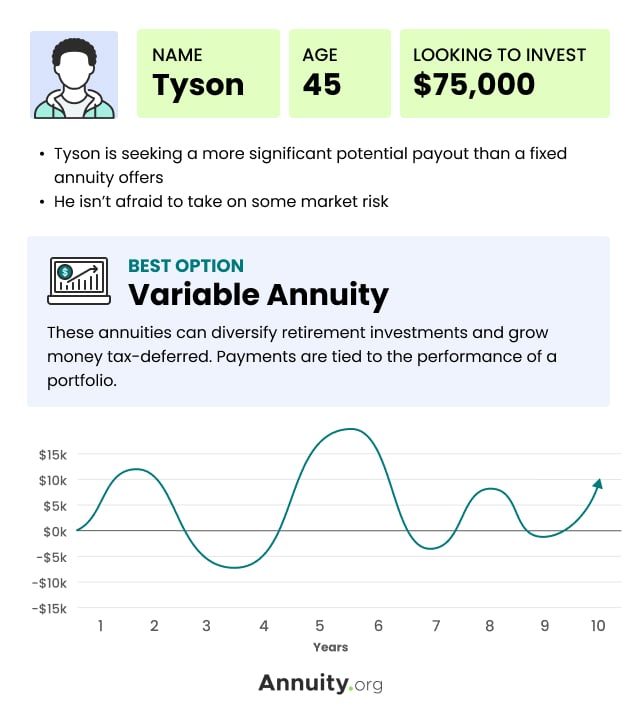

Variable annuities: Supplies better possibility for growth by spending your cash in investment options you select and the capability to rebalance your profile based upon your preferences and in such a way that aligns with altering financial objectives. With taken care of annuities, the firm invests the funds and offers an interest rate to the client.

When a fatality insurance claim takes place with an annuity, it is crucial to have a called beneficiary in the agreement. Various options exist for annuity fatality advantages, depending upon the agreement and insurance company. Selecting a refund or "period specific" option in your annuity supplies a survivor benefit if you die early.

How long does an Guaranteed Return Annuities payout last?

Naming a recipient other than the estate can help this procedure go more efficiently, and can help guarantee that the proceeds go to whoever the individual desired the money to head to rather than undergoing probate. When present, a fatality benefit is immediately consisted of with your contract. Relying on the kind of annuity you purchase, you might be able to include improved survivor benefit and functions, yet there can be added costs or costs associated with these attachments.

Table of Contents

Latest Posts

Understanding Annuities Variable Vs Fixed Key Insights on Variable Annuities Vs Fixed Annuities Defining the Right Financial Strategy Benefits of Fixed Indexed Annuity Vs Market-variable Annuity Why F

Decoding How Investment Plans Work A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosi

Analyzing Strategic Retirement Planning A Closer Look at Variable Annuities Vs Fixed Annuities What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosi

More

Latest Posts